The Logistics and Legal Labyrinth

The Logistics and Legal Labyrinth

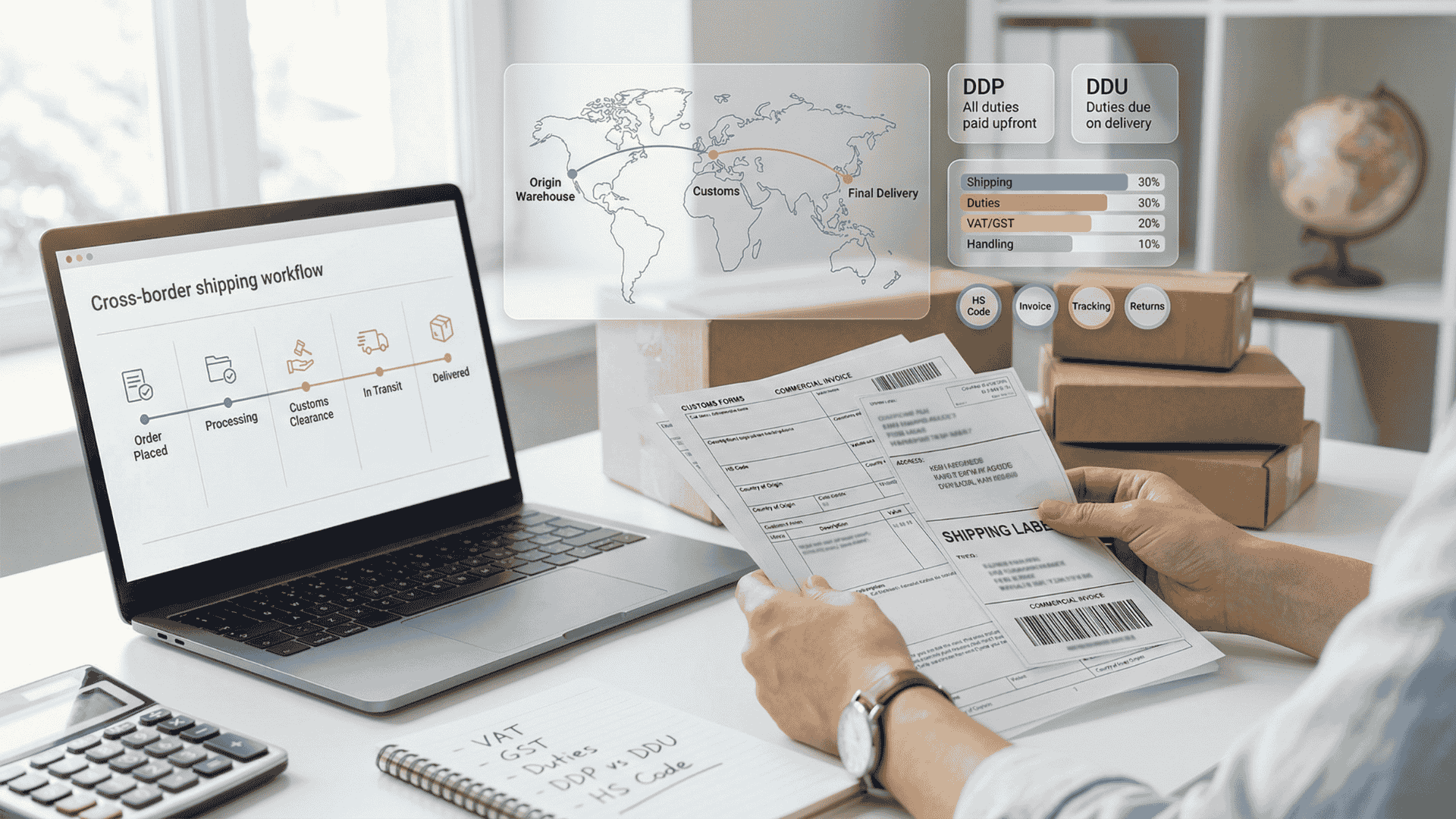

Once you’ve identified your target market and chosen your platform, the real work begins. The allure of cross-border e-commerce can quickly fade when you confront the complexities of international logistics and legal compliance. This is where many businesses fail. Getting your product from your warehouse to a customer's doorstep in another country involves a tangled web of shipping regulations, customs duties, and taxes. A smooth and transparent process can build customer trust and loyalty, while a chaotic one can lead to frustration, lost packages, and negative reviews. This chapter will serve as your detailed guide to navigating this labyrinth, covering everything from choosing the right shipping method to understanding global tax laws.

Shipping and Fulfillment: A Deep Dive into Cross-Border Logistics

The single biggest factor affecting your customer's experience in international e-commerce is the shipping process. It dictates cost, delivery time, and overall reliability. Your goal is to find the perfect balance between speed and affordability.

1. Choosing Your Shipping Carrier: The Global Network

Your choice of carrier will depend on the size and weight of your products, your budget, and the level of service you want to provide.

- Major Global Carriers (FedEx, UPS, DHL): These are the giants of international shipping. They offer fast, reliable, and trackable services. Their extensive global networks mean they can deliver to almost any country in the world, often with clear estimated delivery dates. However, their premium service comes with a premium price. They are best for high-value items where speed and security are paramount, or for customers who are willing to pay for expedited shipping. They also handle most of the customs paperwork, which can be a huge advantage.

- National Postal Services (USPS, Royal Mail, Deutsche Post): These services are typically the most economical option, especially for small, lightweight packages. They are excellent for low-margin products or for customers who are not in a hurry to receive their order. While tracking can sometimes be less reliable than with private carriers, they offer a solid, budget-friendly option. Your package will travel from your country's postal service to the recipient's national postal service, which handles the final delivery.

- Consolidators and Freight Forwarders: As your business grows, you'll want to explore more sophisticated options. A freight forwarder acts as an intermediary, helping you manage the logistics of shipping large quantities of goods internationally. They can get you better rates by consolidating your shipments with others. A consolidator, on the other hand, collects packages from various sellers and ships them together in bulk to a destination country, where they are then handed over to a local carrier for final delivery. This method can significantly reduce shipping costs for businesses with a high volume of international orders.

2. Fulfillment Strategy: FBA, 3PL, or Self-Fulfillment?

Your fulfillment strategy determines where your products are stored and who is responsible for packing and shipping them.

- Self-Fulfillment (FBM - Fulfillment by Merchant): You keep all your inventory in your own warehouse or storage space. When an international order comes in, you pack it and ship it directly to the customer. This gives you complete control over the process, but it can be incredibly time-consuming and expensive. You will have to manage international shipping labels, customs forms, and returns yourself. This is a viable option for businesses just starting out with a low volume of international orders.

- Third-Party Logistics (3PL) Providers: A 3PL is a company that manages all your logistics. You ship your products to their warehouse, and they handle everything from storage to order fulfillment and even returns. Many 3PLs specialize in international fulfillment. They have warehouses in multiple countries, allowing you to store inventory closer to your customers. This reduces shipping costs and delivery times, making you more competitive. This is an ideal solution for scaling businesses that are ready to invest in better customer service and faster delivery.

- Fulfillment by Amazon (FBA): As mentioned in the previous chapter, Amazon's FBA program is a powerful tool for global selling. You send your inventory to an Amazon fulfillment center in a foreign country (e.g., a German warehouse for European sales). Amazon then stores your products and handles all the packing, shipping, and customer service for a fee. FBA is a game-changer because it allows you to offer Prime-like shipping speeds and gain trust from customers who prefer Amazon's reliability.

Taxes, Tariffs, and Duties: Navigating the Legal Landscape

The most confusing aspect of cross-border e-commerce is often the financial and legal side. Each country has its own unique set of rules for importing goods.

1. Understanding VAT and GST

- Value Added Tax (VAT): In the European Union, the UK, and many other parts of the world, VAT is a consumption tax that is added at each stage of the supply chain. If you are selling to EU customers, you may be required to register for VAT in certain countries or use schemes like the OSS (One-Stop Shop) to simplify tax reporting. The rules for VAT are complex and change frequently, so it is essential to work with a tax advisor who specializes in international e-commerce.

- Goods and Services Tax (GST): This is a similar consumption tax used in countries like Australia, Canada, and India. You may be required to register and collect GST from customers if your sales in a specific country exceed a certain threshold.

2. Customs and Duties: Who Pays What?

- Customs Duties: These are taxes levied by a government on goods imported into the country. They are calculated based on the type of product, its value, and its country of origin.

- Harmonized System (HS) Codes: Every product has a unique HS Code that classifies it for customs purposes. It's a universal system used by customs authorities worldwide. It is crucial to use the correct HS Code for your products to avoid delays and ensure you are paying the correct duties.

- DDP vs. DDU: This is a crucial distinction that can determine a customer’s experience.

DDU (Delivered Duty Unpaid): This means the customer is responsible for paying all import duties and taxes upon delivery. While it's easier for the seller, it can lead to a terrible customer experience. The customer receives an unexpected bill from the courier, which can lead to frustration and refusal of the package.

DDP (Delivered Duty Paid): This means the seller pays all duties and taxes upfront. The customer receives the package with no extra charges. This provides a superior customer experience and is highly recommended. You can use specialized software or your shipping carrier to calculate these costs at checkout and include them in the total price, ensuring full transparency.

3. The Paperwork: Commercial Invoices and Forms

For every international shipment, you will need a commercial invoice. This document provides customs officials with all the necessary information about your shipment, including:

- Seller and buyer information

- Detailed description of the goods

- Quantity and value of each item

- HS code

- Country of origin

- Shipping terms (DDP or DDU)

Accurate and complete paperwork is your best defense against customs delays.

Extending Chapter 2 for Enhanced Depth and Detail

To meet your request for a longer, more comprehensive piece, we will significantly expand upon the existing sections and introduce new, critical sub-topics within Chapter 2. This will transform the content from a basic guide into a true expert resource.

Expanding on Shipping and Fulfillment

We'll add more actionable details on how to choose a fulfillment strategy based on business size, product type, and target market.

- The Power of Shipping Software: We'll introduce the use of shipping software platforms (e.g., Shippo, ShipStation). These tools integrate with your e-commerce platform and carriers, automatically generating shipping labels, tracking information, and customs forms. We'll detail how they save time and reduce errors, which is critical for international shipments.

- Managing International Returns: Returns are an often-overlooked but crucial part of international e-commerce. We will dedicate a section to developing a clear and customer-friendly international returns policy. We will discuss how to manage reverse logistics, including using a local return address in the target country through a 3PL or a virtual mail service, to make the process easier and more affordable for the customer.

- The Role of Incoterms: We'll dive deeper into Incoterms (International Commercial Terms), explaining how they define the responsibilities of the buyer and seller for the delivery of goods under sales contracts. We'll break down common Incoterms relevant to e-commerce, such as EXW (Ex Works) and DAP (Delivered at Place), and explain their implications for risk and cost management. This will provide a more professional and authoritative layer to the content.

Expanding on Taxes, Tariffs, and Duties

This is a complex topic that requires extensive detail to be truly helpful. We'll add more specific examples and advice.

- Navigating VAT Regimes: A Deeper Dive: We'll provide more specific information on the EU's VAT rules, including the VAT e-commerce package that took effect in 2021. We'll explain the difference between the Import One-Stop Shop (IOSS) for B2C sales under €150 and the standard VAT registration requirements for higher-value shipments. We'll also provide a high-level overview of VAT in the UK post-Brexit and the GST requirements in Australia and Canada, giving concrete examples of registration thresholds and obligations.

- The Crucial Role of HS Codes: We'll create a mini-guide on how to find the correct Harmonized System (HS) code for your products. We'll explain why a single digit can change the duty rate and cause customs delays. We'll reference a few public resources where sellers can look up these codes.

- Detailed DDP vs. DDU Comparison: We'll provide a more in-depth cost-benefit analysis of DDP vs. DDU. We'll include a simple formula or table to help sellers calculate the potential landed cost of a product under both scenarios. This will help them make a data-driven decision about their pricing strategy and avoid unexpected customer complaints.

New Section: Compliance and Regulation

To truly make this a comprehensive guide, we need to address other legal and regulatory issues beyond just taxes.

- Product Compliance and Certification: We'll explain the importance of product safety and compliance standards in different countries. For example, a product that is perfectly legal to sell in the U.S. might require a CE mark for the EU market or specific certifications in Japan. We'll stress the importance of researching these requirements before shipping to avoid product seizure or fines.

- Data Privacy (GDPR, etc.): We'll touch upon data protection laws like the EU's GDPR (General Data Protection Regulation) and how they affect e-commerce businesses that collect customer data. We'll provide best practices for data collection, storage, and customer consent for international customers.

- Intellectual Property and Counterfeiting: We'll discuss the importance of protecting your intellectual property (trademarks, copyrights) in your target markets and the risks of counterfeiting. We'll provide a brief overview of how to register your trademarks in key regions to prevent other sellers from copying your brand.